What determines governance at sovereign wealth funds?

By Duncan Mayall

Two things well-governed sovereign wealth funds have in common

Sovereign wealth funds may have a reputation for opacity, but good governance can help to change perceptions and ensure they retain access to international financial markets and gain the trust of leading global investors.

Sovereign wealth funds (SWFs) are as diverse as the countries they are founded in. They range from funds with a few hundred million dollars to others with more than $1 trillion of assets under management. Some disclose all their investments, while others take a more conservative approach to transparency. Standards of governance, and perceptions of governance practices, are also divergent across the world’s SWFs: some are tightly run organizations with demonstrable levels of accountability and transparency, while others have markedly lower levels of governance.

While SWFs face the same issues as any investor, they are often subject to more scrutiny. Being owned by national (or, in some cases, sub-national) governments heightens the risk that they are perceived as being politically, and not economically, driven. Furthermore, as a class, they have, fairly or unfairly, acquired a reputation for opacity.

Consequently, governance levels become key for maintaining perceived legitimacy as a player in major financial markets or a partner to blue-chip investors.

So, what leads to a SWF being well-governed? Our analysis suggests that while discussing SWFs as a single group is difficult, two common threads emerge that could guide policymakers and investors. First, it appears that the governance of a SWF is driven in part by the standards of governance within its home country. Second, SWFs that are members of the International Forum of Sovereign Wealth Funds (IFSWF) — an international body that maintains and promotes an agreed set of principles and practices for SWFs — seem to display higher levels of transparency and governance than non-members.

Why sovereign wealth funds matter

There are three main reasons why SWFs matter.

Firstly, they control significant financial assets. The consultancy Global SWF estimates that SWFs’ assets under management exceeded $10 trillion in 2022. While this remains a fraction of overall global financial assets, SWFs are an important — and increasingly prominent — investor class. Furthermore, they play an outsize role in certain asset classes. Global SWF estimates that SWFs, along with public pension funds, hold about $500 billion in hedge funds — equivalent to 25 percent of the total industry size. For many years, SWFs attracted relatively limited attention: Dixon, Schena, and Capapé argue that before their rise in prominence in the 2000s, “few people were aware” SWFs existed.[1] This is certainly not the case today.

Secondly, many SWFs are playing an increasingly active role in their domestic economies as well as in both public and private international financial markets. While SWFs have existed in some form for several decades, they were initially focused largely on either providing long-term savings or budget stabilization. They were generally funded through excess commodity revenues or foreign currency holdings. They also typically invested exclusively in foreign markets. Now, however, an increasing number of SWFs invest domestically on a commercial basis in support of strategic economic objectives.

Alongside the shift in how SWFs invest, there has also been a change in how they are funded. Several SWFs are now provided with endowments of government assets (such as shares in state-owned companies) or one-off capital transfers. These SWFs then derive capital for operational costs and additional investments from a variety of sources, including returns on existing investments and debt issuance. This has been a particularly popular approach with so-called strategic funds and generally requires additional expertise and capacity.

Thirdly, there has been a sharp rise in the number of SWFs in recent decades, and many more are in the planning stages. As well as a shift in the types of SWFs being established, there has been an increase in the number of funds established. Of the 77 SWFs listed in the latest IFSWF Annual Review[2], 58 were founded after 2000. While this may partly reflect the fact that some funds founded earlier on have since been closed, the broader trend appears clear — and looks set to continue this decade. According to the IFSWF, four new SWFs have been reported since 2020, with Global SWF reporting that another ten have been proposed and are in the process of being established.

Why governance is especially important for SWFs

For many sovereign wealth funds, the ability to invest in international markets — or to attract co-investment from international investors — is central to their strategy. As a result, maintaining access to these markets and partners is essential. At a time when protectionist sentiment is increasing across the world, access cannot be taken for granted in the way it has been in the past.

For many years, SWFs had no agreed standards and attracted relatively limited attention. However, this changed in the early 2000s when such funds became more prominent and drew additional scrutiny.

This change was driven by several factors. First, a period of high commodity prices in the 2000s provided significant capital to fund investments by existing SWFs and create new funds. Likewise, considerable trade surpluses in several East Asian countries during the same period had a similar effect. Second, tension around foreign ownership of critical infrastructure and assets spiked when US politicians raised around US port security following DP World’s takeover of P&O in 2006, which would have seen it responsible for the management of some US port operations.[3] Third, several SWFs played a prominent role in supporting major Western financial institutions during the 2007-08 global financial crisis.

Collectively, these factors attracted increased attention to SWFs and their operations. This, in turn, increased pressure on funds regarding governance and the extent to which funds were seen to operate with purely commercial objectives versus broader strategic political or economic objectives.

Unearthing the correlations: developing a new model

While there have been efforts to establish common principles and practices among SWFs, these initiatives fall short of a common set of standards followed by all, or a majority, of such funds.

In the autumn of 2007, the International Monetary Fund (IMF) convened the International Working Group of SWFs to draft a set of generally accepted principles and practices, which would eventually become known as the Santiago Principles.[4] This working group eventually transformed into the IFSWF, which now lists 37 full members and six associate members, including many of the world’s leading SWFs.

These efforts have had some success, but challenges remain.

On the one hand, Maire, Mazarei, and Truman (2021) note that “the average scores [on the Truman Scorecard] have continued to improve,” including both overall averages and those funds which have been included since the initial scorecard.[5] Likewise, Dixon, Schena, and Capapé argue that material progress is observable among SWFs’ published self-assessments of their compliance with the Santiago Principles.[6]

However, while it appears there has been an improvement in governance, it is also clear that for many SWFs, their level of governance remains below the levels found in other major government financial institutions within the country, such as finance ministries and central banks. It is also less clear what is driving higher levels of governance among some funds.

Establishing why some SWFs have higher governance standards than others could provide insights that would enable policymakers to develop effective approaches to enhance governance across SWFs more broadly.

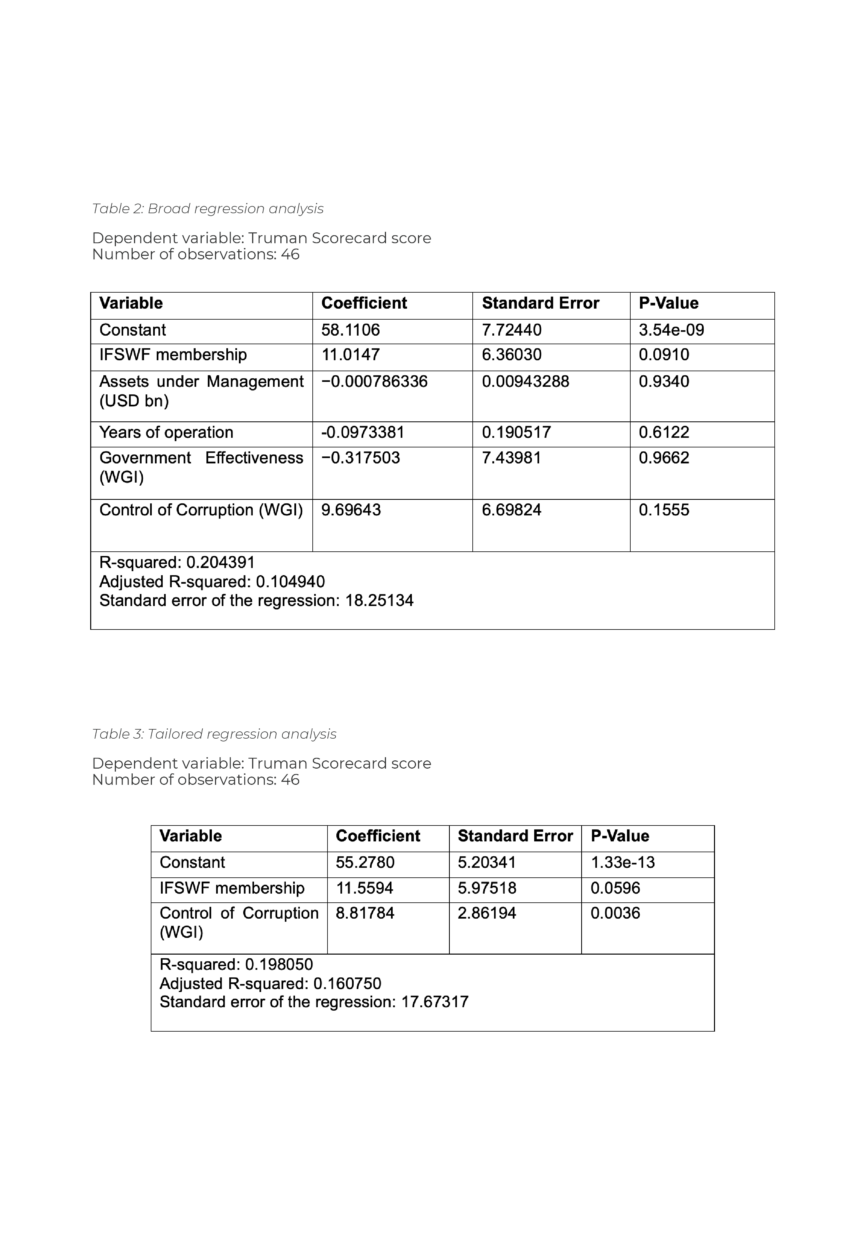

To establish which factors are correlated with higher standards of governance, we used the latest edition of the SWF scorecard, developed by Edwin Truman as a proxy for governance at SWFs, and conducted regression analysis across five key variables.

Two key factors had a major influence on levels of governance. First, whether the fund was a member of IFSWF, the body responsible for the Santiago Principles. Second, the level of governance in a fund’s “home country”, as established by using the country’s score in the “control of corruption” subset of the World Bank’s Worldwide Governance Indicators.

We found no correlation between governance levels and the size of assets under management, the number of years a fund had been in operation, or the country’s score for government efficiency in the World Bank’s Worldwide Governance Indicators.

Through this analysis, we have developed a model that explains around 20 percent of the variance in a fund’s score in the Truman SWF scorecard.

Joining the dots: what our analysis revealed

Given the imprecise nature of the data involved, any conclusions are necessarily somewhat tentative. One of the key insights is confirming the highly heterogeneous nature of SWFs. It remains difficult to speak extensively of SWFs as a group because of their diversity as a class. It also seems clear that the factors covered in this paper provide only a partial account of governance among SWFs.

However, the results do provide evidence to back up the hypothesis that governance among SWFs is driven in part by the standards of governance within their home country.

Notably, membership of the IFSWF is correlated with higher levels of transparency and governance. Given that the Truman Scorecard is based on the Santiago Principles — against which members of the IFSWF are expected to assess their level of compliance — this is perhaps not surprising. And clearly, the correlation could run in both directions: it may also be the case that SWFs with a higher commitment to strong governance are more likely to join a body such as the IFSWF.

However, it is encouraging that membership of the organization does appear to correlate with changes in SWFs’ behavior, which also echoes the finding in Maire, Mazarei, and Truman (2021) that “the 36 members and associate members of the IFSWF have a slightly higher average [score in the Truman Scorecard] (69) than the 28 non-members (62)”.[7]

Implications for policy makers

For policymakers, the findings prompt two key considerations. First, there should be an expectation among policymakers encouraging the creation of SWFs that the funds are likely to reflect the broader level of governance within the country. This is certainly not to discount the use of SWFs, but it does highlight that SWFs created in a country with poor governance are unlikely to resemble prominent SWFs in other markets without significant efforts.

Second, the absence of a clear definition of SWFs or rigid norms or regulations around their governance has led to a considerable diversity of approach. The possible correlation between membership of IFSWF and higher governance scores suggests that adopting voluntary standards may have some impact on governance standards — and that efforts to support and strengthen these standards may prove effective in driving broader improvements. However, as noted above, the causality implied by this conclusion would need to be qualified.

Implications for further research

Further research could track these relationships over time, using historical (and future) data to establish how far SWFs’ governance changes over time and the extent to which this is related to broader factors (such as changes in government control of corruption) or to institutional factors.

Likewise, further research could examine institutional factors that may inhibit a SWF’s governance and account for some of the variance in the Truman Scorecard, which is left unexplained by the model in this paper. This could include an analysis of SWFs’ internal human capital — such as the number and seniority of employees — and institutional constraints, such as the legal structure of the SWF and its mandate.

Appendix: The SWF governance model

Data

Assessing levels of governance is an imprecise science. To provide a working proxy for SWFs’ level of governance, we used the most recent edition of the scorecard developed by Edwin Truman (“the Truman Scorecard”). This scorecard was first published by Truman (2009), and its most recent iteration was published by Maire, Mazarei, and Truman (2021). It assesses a SWF’s compliance regarding 33 equally weighted factors and scales this score to 100.

This data set has several advantages.

First, the exercise has been conducted on four separate occasions, meaning that further research could analyze these findings against previous iterations of the Truman Scorecard, assessing the degree to which trends are constant or have changed over time.

Second, the survey is designed to be comparable with the elements of the Santiago Principles and so reflects a set of common standards for SWFs as drafted in part by a group of SWFs. This suggests it reflects an idea of transparency as envisaged by the sector.

Third, while the survey reflects information from 2019, it is close enough in time to the other data used to provide a robust comparison. While previous iterations of the Truman Scorecard demonstrate that funds can, and have, improved their score, it is unlikely they would see significantly different outcomes in the space of a couple of years. Therefore, the Truman Scorecard provides a decent picture of their levels of transparency as they currently stand.

Fourth the Truman Scorecard assesses a broad range of governance indicators, giving a more complete view of SWFs operations than alternatives such as the Linaburg-Maduell Transparency Index, which only assesses ten.

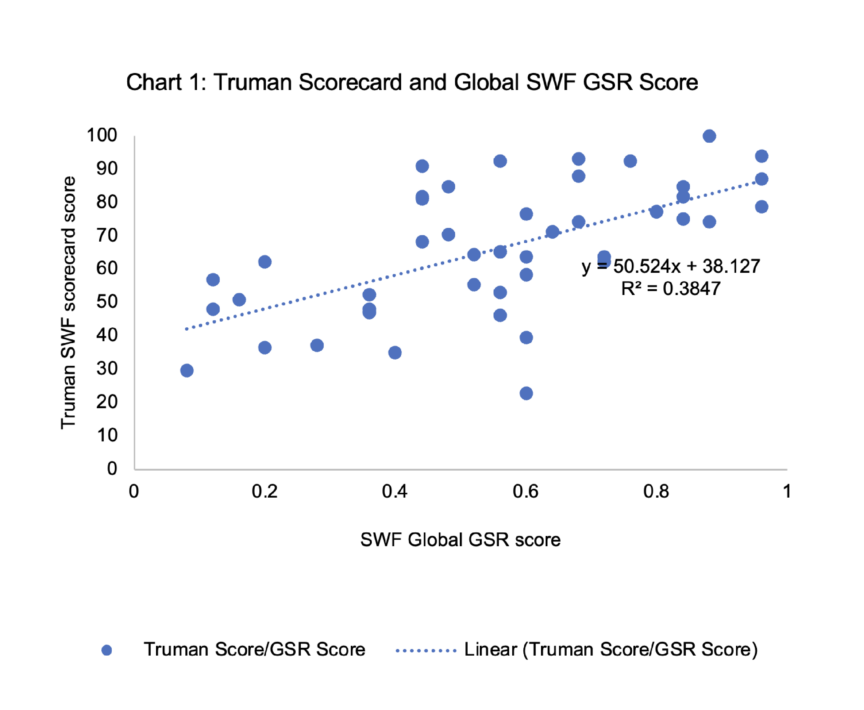

Furthermore, we have compared SWFs’ scores in the Truman Scorecard to their scores on the GSR Index, developed by the consultancy Global SWF (Chart 1), which aims to act as an assessment tool for the best practices of state-owned investors and looks to assess SWFs’ governance, sustainability and resilience. While the scores measure different elements, there is a reasonably strong correlation between the two metrics, which suggests a certain element of consistency in how SWFs are assessed in this area.

The other data sets we have used are broadly straightforward. We have used the IFSWF’s definition of each SWF’s year of formation, as included in its 2021 Annual Review. SWFs are not uniform in their practice of reporting their level of assets under management, and several funds do not do so at all. As a result, we have used the estimates published by the consultancy Global SWF in its 2023 Annual Report, which uses publicly disclosed information where available and informed estimates where it is not.

To assess governance and government capacity levels in the fund’s “home country,” we have used the World Bank’s Worldwide Governance Indicators. Again, assessing levels of governance and government capacity is inexact. However, the World Bank’s indicators provide arguably the most widely respected and credible assessment available and are derived from more than 30 underlying data sources.

Most SWFs are owned by a sovereign state, but a significant minority — 17 percent of the data set in this paper — are owned by sub-national governments. In this instance, we have used the scores for the state as a whole as the best approximation.

One significant challenge was which SWFs to include in the research. There is no definitive list of SWFs, and, as a result, each of the data sets this paper draws on covers a slightly different list of funds. For completeness, this paper includes SWFs present in all the data sets — an approach that comprises 46 funds, including the most notable ones.

There is a risk that the results could be affected by the fact that several countries have more than one SWF — held either at national or sub-national level. While this accounts for 15 of the 46 SWFs in the data set, only two countries — the United States (three funds) and the United Arab Emirates (four funds) — account for more than two SWFs. All three US funds record similar scores on the Truman Scorecard (ranging from 82 to 93), but there is significant divergence within the UAE funds between the highest scoring SWF (Mubadala, which scores 75) and the lowest (Emirates Investment Authority, which scores 36). It is unlikely that this has a significant impact on the findings of this paper, but it may be important to note in designing further research.

Analysis

The broad regression analysis in Table 2 demonstrates that several variables have very high p-values and are unlikely to contribute to a workable model. Assets under management, years of operation, and government effectiveness have very small coefficients and p-values that suggest they are not significant. The model as a whole has an adjusted R-squared of only 0.105 with a standard error of 18.25.

Removing the three non-significant variables (Table 3) leads to an increase in the adjusted R-squared to 0.161 with an R-squared of 0.198, a standard error of 17.67, and ensures all variables are significant — or on the border of significance — at the 5 percent level.

The coefficient for the IFSWF membership dummy variable is 11.56, suggesting that membership of the body is correlated with a fairly significant increase in a fund’s score on the Truman Scorecard (albeit with a standard error of 5.98).

Marks on the Truman Scorecard range from 23 to 100, with a mean of 67 and a standard deviation of 19.29. Looked at from a different perspective, given that the Truman Scorecard is composed of 33 equally weighted elements, it is the equivalent of ensuring compliance with a further 3.85 elements.

The coefficient for the Control of Corruption variable is 8.82, with a standard error of 2.86. Given that the Control of Corruption score ranges from -2.5 to +2.5, with a mean of 0 and a standard deviation of 1, this suggests that a one standard deviation improvement of a country’s score in the Control of Corruption index is associated with an increase in its score on the Truman Scorecard of 8.82 or ensuring compliance with a further 2.94 elements.

In both instances, the coefficients suggest a significant correlation between the independent and dependent variables, but the standard errors mean the findings must be significantly qualified, as demonstrated by the broad dispersion of the results visible in Chart 2.

About the author

Duncan Mayall is an economic communications specialist and analyst with more than fifteen years of experience in advising government entities on international investment issues – both attracting investment and communicating their own investment conducted through sovereign wealth funds. He has worked with sovereign wealth funds and international investment promotion entities in a number of countries, including Bahrain, Saudi Arabia, Iraq, Morocco and China.

His long-held focus on economic communications and analysis enables him to help clients to navigate a complex global environment and supplement their efforts with original research and analysis.

References

[1] Capapé J, Dixon A, and Schena P, “Sovereign wealth funds: Between the state and markets,” Newcastle-Upon-Tyne: Agenda Publishing, 2022.

[2] Data drawn from: International Forum of Sovereign Wealth Funds (2022) “A year of more: IFSWF Annual Review 2021.” Available at: https://www.ifswf.org/publication/year-more-ifswf-annual-review-2021

[3] Capapé J, Dixon A and Schena P, “Sovereign wealth funds: Between the state and markets,” Newcastle-Upon-Tyne: Agenda Publishing, 2022, page 39

[4] https://www.ifswf.org/sites/default/files/Publications/transpdialog0614_0.pdf

[5] Maire J, Mazarei A, and Truman E, “Sovereign wealth funds are growing more slowly, and governance issues remain,” Policy Brief: Peterson Institute for International Economics, 2022, Policy Briefs 21-3, page 2. Available at: https://www.piie.com/publications/policy-briefs/sovereign-wealth-funds-are-growing-more-slowly-and-governance-issues

[6] Capapé J, Dixon A and Schena P, “Sovereign wealth funds: Between the state and markets,” Newcastle-Upon-Tyne: Agenda Publishing, 2022, page 49.

[7] Maire, J, Mazarei A and Truman E, “Sovereign wealth funds are growing more slowly, and governance issues remain,” Policy Brief: Peterson Institute for International Economics, 2022, Policy Briefs 21-3, page 10. Available at: https://www.piie.com/publications/policy-briefs/sovereign-wealth-funds-are-growing-more-slowly-and-governance-issues

Selected Bibliography

- Al-Hassan, A., Papaioannou, M., Skancke, M. and Sung, C. (2013) “Sovereign wealth funds: Aspects of governance structures and investment management,” IMF Working Paper. Available at: https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Sovereign-Wealth-Funds-Aspects-of-Governance-Structures-and-Investment-Management-41046

- Babić, M. (2023) “The rise of state capital: Transforming markets and international politics,” Newcastle-Upon-Tyne: Agenda Publishing. Available at: https://www.agendapub.com/page/detail/the-rise-of-state-capital/?k=9781788215725

- Bagnall, A. and Truman, E. (2013) “Progress on sovereign wealth fund transparency and accountability: An updated SWF scoreboard,”’ Policy Brief: Peterson Institute for International Economics, Policy Briefs 13-19. Available at: https://www.piie.com/publications/policy-briefs/progress-sovereign-wealth-fund-transparency-and-accountability-updated

- Cuervo-Cazurra, A., Grosman, A., and Wood, G., (2023) “Cross-country variations in sovereign wealth funds’ transparency,” Journal of International Business Policy. Available at: https://link.springer.com/article/10.1057/s42214-023-00149-0

- Das, U., Mazarei, A. and Van der Hoorn, H. (2010) “Economics of sovereign wealth funds: Issues for policymakers,” Washington D.C.: International Monetary Fund. Available at: https://www.imf.org/external/pubs/nft/books/2010/swfext.pdf

- Dixon, A. (2014) “Enhancing the transparency dialogue in the ‘Santiago Principles’ for sovereign wealth funds,” Seattle University Law Review, 37 (2), pp. 581-595. Available at: https://www.ifswf.org/sites/default/files/Publications/transpdialog0614_0.pdf

- Dixon, A., Schena, P. and Capapé, J. (2022) “Sovereign wealth funds: Between the state and markets,” Newcastle-Upon-Tyne: Agenda Publishing.

- Global SWF (2023) “2023 Annual Report,” Available at: https://globalswf.com/reports/2023annual

- International Forum of Sovereign Wealth Funds (2023) “Newton’s second law: Sovereign wealth funds’ progress on climate change.” Available at: https://www.ifswf.org/publication/newtons-second-law-sovereign-wealth-funds-progress-climate-change

- International Forum of Sovereign Wealth Funds (2022) “A year of more: IFSWF annual review 2021.” Available at: https://www.ifswf.org/publication/year-more-ifswf-annual-review-2021

- Maire, J., Mazarei, A. and Truman, E. (2021) “Sovereign wealth funds are growing more slowly, and governance issues remain,” Policy Brief: Peterson Institute for International Economics, Policy Briefs 21-3. Available at: https://www.piie.com/publications/policy-briefs/sovereign-wealth-funds-are-growing-more-slowly-and-governance-issues

- Meggison, W., Lopez, D. and Malik, A. (2021) “The rise of state-owned investors: Sovereign wealth funds and public pension funds,” Annual Review of Financial Economics, forthcoming. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3712690

- Monk, A., (2008) “Recasting the sovereign wealth fund debate: Trust, legitimacy, and governance,” New Political Economy, 14 (4), pp. 451-468. Available at: https://www.tandfonline.com/doi/abs/10.1080/13563460903287280

- Rozanov, A. (2005) “Who holds the wealth of nations?” Central Banking, 20 May 2005. Available at: https://www.centralbanking.com/central-banks/financial-stability/2072255/who-holds-the-wealth-of-nations

- Schena, P. and Collins R. (2023) “Implementing the Santiago Principles: Lessons from member self-assessments,” International Forum of Sovereign Wealth Funds. Available at: https://www.ifswf.org/sites/default/files/Santiago%20Principles%202022%20FINAL.pdf

- Stone, S. and Truman, E. (2016) “Uneven progress on sovereign wealth fund transparency and accountability,” Policy Brief:Peterson Institute for International Economics, Policy Briefs 16-18. Available at: https://www.piie.com/publications/policy-briefs/uneven-progress-sovereign-wealth-fund-transparency-and-accountability

- Truman, E., (2009) “A blueprint for sovereign wealth fund best practices,” Revue d’économie financière, Special Issue 2009, pp. 429-451. Available at: https://www.persee.fr/doc/ecofi_1767-4603_2009_hos_9_1_5526