The nations preparing for the immersive digital future

An analysis of metaverse preparedness amongst world governments

By Isabella Williamson

A world in rapid transition

From virtual tourist trips and airline check-ins to virtual ministries and digital twins of whole cities, the world is rapidly transitioning to a more immersive digital era.1 Take Minecraft: between 2011 and 2022, the virtual sandbox game’s monthly active user base grew from 10 million to 173 million.2 With the rising importance of virtual worlds, governments are now considering how best to support their citizens and institutions in the years to come.

As public policies around the metaverse grow in number, this study explores which nations are best equipped to transition into, and thrive within, the emerging immersive digital era. The insights gained point to key actions governments large and small can take to best position themselves.

A surge of metaverse initiatives

The concept of virtual worlds is not new to governments. Countries such as Sweden, Estonia and the Maldives started innovating in this space decades ago with the launch of embassies in 3D virtual world Second Life.3 They recognised then that virtual spaces may be important for government services and global soft power in the internet of the future.

That future is now. With the consolidation of technological advancement, digital infrastructure, popular demand and environmental pressures, the metaverse and its core technologies – including extended reality (XR), artificial intelligence (AI), and blockchain – have progressed at a startling pace. On cue, we’ve seen an explosion of related policy initiatives.

Over the past two years, countries such as the UAE, South Korea, Finland and Mainland China have launched national metaverse strategies, while the European Union has published a strategy on Web 4.0 and virtual worlds. Other initiatives include South Korea’s Metaverse Fund and Metaverse Academy to support a growing metaverse ecosystem, Indonesia’s Metaverse Collaboration Initiative to drive public-private-sector partnerships, the French government’s public consultation on the representation of national identity in the metaverse, and China’s development of industry standards to guide businesses as the metaverse economy grows.4

Here, we explore this emerging policy landscape to identify which nations seem best equipped to transition into, and thrive within, the metaverse.

The landscape is complex. For example, some digitally advanced nations that rose as early adopters are contending with low current public interest. Other smaller nations with resourcing constraints have shown remarkable proactivity in the metaverse, seeing the strategic advantages it can deliver in advancing global visibility and collaboration.

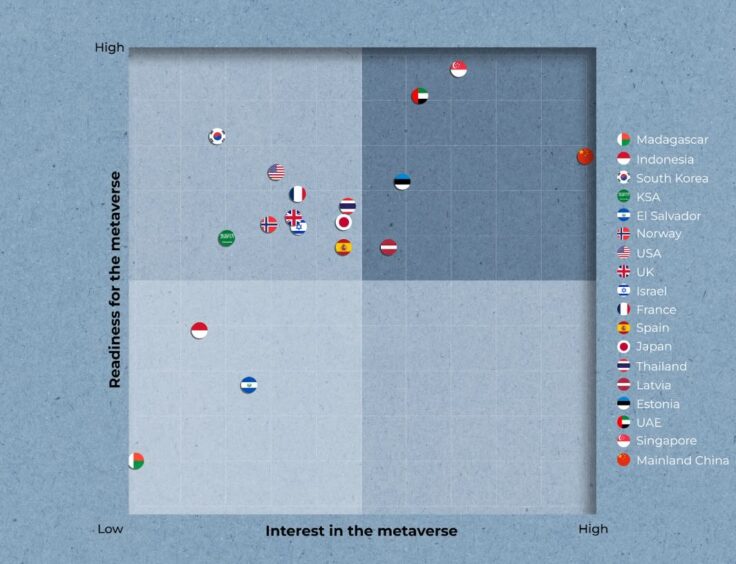

The following diagram maps the results of our research into how prepared each of these countries are to support their metaverse ambitions, as well as their citizens’ level of interest in this endeavour:

Benchmarking preparedness for the metaverse

Which nations are doing the right things to prepare themselves? We explored that question across 18 governments, examining each country’s current readiness to support their metaverse ambitions as well as citizens’ level of interest in this endeavour.5 Both factors are crucial in shaping a robust metaverse ecosystem.

Readiness scores were computed by assessing the local digital talent, physical infrastructure and business environment, while interest levels were derived from search-engine statistics (specifically, the frequency of searches for the word “metaverse”).

Benchmarking levels of readiness and interest in this way provides a richer understanding of where each country stands on its metaverse journey and provides insights into the ideal recipe for prospering in the future.

In our analysis, we discovered that nations varied widely in metaverse readiness and interest, falling into three broad clusters:

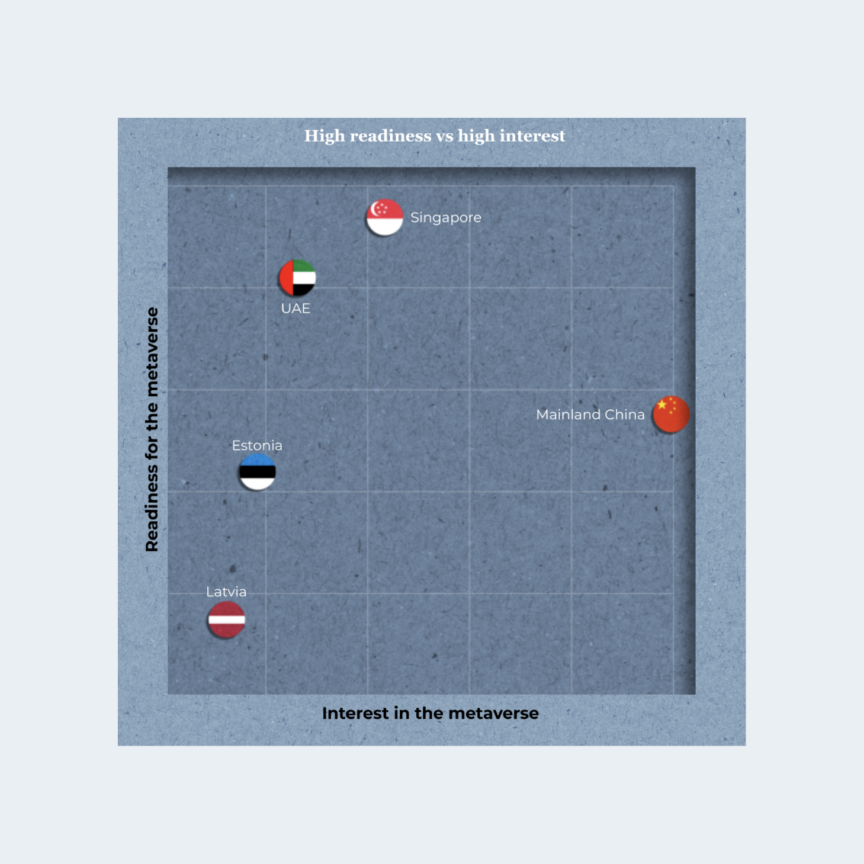

High readiness and high interest

- Mainland China, the UAE and Singapore all have high readiness combined with high interest.

- Singapore leads in readiness, while Mainland China shows the highest population interest.

Mainland China

China has a strategic focus on digital transformation and the power of data to boost growth. It boasts a robust digital ecosystem of tech giants like Alibaba, Tencent and Huawei, and invests heavily in new technologies such as 5G infrastructure, AI and blockchain. China’s Ministry of Industry and Information Technology (MIIT) has released a Three-Year Action Plan for Metaverse Industry Development, and recently announced plans to work towards establishing standards for the sector.6 Individual cities, including Beijing, Nanjing, Shanghai and Shandong, have also unveiled ambitious metaverse plans.7

The United Arab Emirates

The UAE is advancing as a digital powerhouse with ambitious projects like the Dubai Metaverse Strategy, aiming for innovation, economic growth, and the creation of 40,000 virtual jobs.8 Key projects include a digital twin of Dubai, Metaverse Dubai, Dubai Electricity and Water Authority’s “DEWAVerse”, and Sharjah’s government’s Virtual Transaction Centre in the metaverse.9

Singapore

Singapore’s thriving tech industry is renowned across Southeast Asia and it enjoys high digital literacy with widespread internet access. This is in part a result of the 2014 Smart Nation initiative, which aims to transform the nation by leveraging technology and data across government, economy and society. In terms of the metaverse, the Asian city-state was one of the first globally to launch a digital twin of an entire nation using topographical and real-time data. The digital twin simulated and tested solutions to urban-planning problems and offered a platform for citizens to participate in Smart City projects.10

Observations

These are technology-forward nations with robust digital infrastructure, high digital literacy and thriving tech start-up ecosystems, guided by comprehensive digital-transformation strategies that stretch across society, economy and government. Both public and private sectors have identified the potential of the metaverse and taken quick action to seize its benefits while managing its risks. Poised to emerge as leaders in the global metaverse economy, these nations may find collaboration challenging as they vie for leadership.11

High readiness and low interest

- South Korea scored fourth in readiness – but came close to the bottom in public interest. A similar disparity is found in the United States.

- The United Kingdom, Norway and the Kingdom of Saudi Arabia (KSA), while in the mid-range of readiness, also show relatively low public interest – with KSA ranking fourth lowest overall.

South Korea

South Korea was one of the first nations to create a roadmap for developing a competitive metaverse ecosystem, which it titled the “Expanded Virtual World”.12 The Minister of Science and ICT, Lim Hyesook, called the metaverse “an uncharted digital continent with indefinite potential”.13 Building on its Digital New Deal, which takes a comprehensive approach to developing a competitive digital economy, in 2022 the government launched a Digital New Deal 2.0 – dedicating KRW 223.7 billion (USD 186.7 million) to a pan-government metaverse strategy.14 The strategy has several foci: boosting metaverse platform growth and its wider ecosystem; developing metaverse talent and encouraging participation in metaverse activities; supporting specialised metaverse companies with infrastructure and funding; and building a model virtual world.15

The United States

The US government signalled interest in the development of the metaverse with its 2022 CHIPS and Science Act, which directs the National Science Foundation (NSF) to research immersive technology.16 Several other government bodies, including the US Army and NASA, are exploring metaverse opportunities; for example, the Army uses a Synthetic Training Environment (STE) to simulate realistic scenarios and help soldiers train effectively.17 However, the United States doesn’t have an explicit strategy for the metaverse.

The United Kingdom

The United Kingdom aims to become a global science and tech superpower and its Digital Strategy is designed to cultivate the digital economy required to support this ambition.18 According to the UK’s Spring Budget, the UK wants to “lead on the future of web technology, sometimes known as Web3 or the metaverse”.19 This effort will be led by the government’s newly formed Department of Science, Innovation and Technology. In parallel, the UK recently passed an Online Safety Bill, which also applies to the metaverse.20 In terms of immersive-technology initiatives, the country’s Roadmap 2035 commits the UK to supporting businesses in innovative sectors such as Augmented Reality (AR) and Virtual Reality (VR).21 VR is currently being used to enhance training for soldiers, sailors, and aviators under a GBP 7.2 million (USD 8.9 million) contract secured by Defence, Equipment and Support in 2022.22

The Kingdom of Saudi Arabia

In KSA, the government supports numerous digital projects as part of its ambitious Vision 2030 programme, several with metaverse components. KSA has committed over USD 6.4 billion to advanced technologies, including a USD 1 billion investment in the metaverse-dedicated NEOM Tech & Digital Company.23 In collaboration with Meta Platforms, the country launched the Middle East’s first metaverse academy to drive technological growth.[24] In addition, the Royal Commission for AlUla launched a metaverse project to give tourists virtual access to World Heritage site the Tomb of Lihyan, son of Kuza, in Hegra; while the NEOM project’s Tech & Digital sector introduced XVRS, a “cognitive digital-twin metaverse”.25

Norway

The Ministry of Local Government and Modernisation in Norway released a digital strategy to support digital transformation of the entire public sector. The Brønnøysund, a government body under the Ministry of Trade, Industry and Fisheries, has established the world’s first tax office in Decentraland, with the goal of delivering services to young, tech-native citizens.26

Observations

Most of these governments are early adopters, taking proactive steps to craft plans around the metaverse. In this they anticipate both future demand (for example, Seoul’s Digital New Deal 2.0) and associated risks to consumers (for example, the UK’s Online Safety Bill’s metaverse references).

But while these countries’ technological infrastructure is robust, relatively low interest rankings suggest that the public is still catching up with the tech evolution. Ensuring that metaverse initiatives are developed in ways that tangibly benefit society, and that this is effectively communicated through public-awareness campaigns and education opportunities, may help to drive up engagement.

Low readiness and low interest

- Indonesia, Madagascar and El Salvador score low in both readiness and interest.

Madagascar

The government of Madagascar has plans to establish a virtual embassy and virtual National Exhibition Centre to drive trade and business opportunities, and aims to improve service delivery through the latest technologies.27

El Salvador

El Salvador’s government is actively striving to enable digital innovation through the Digital Agenda 2020-2030. The country’s Technology and Economy International Affairs Director has announced the development of an NFT-based Crypto Casino, which will be accessible physically and virtually.28

Indonesia

Indonesia’s government recently launched the Metaverse Collaboration Initiative, a public-private partnership aimed at promoting collaboration, research, innovation and development in metaverse technologies.29 Through PT Telkom Indonesia, the government is supporting the development of MetaNesia, a state-owned metaverse designed to support and promote SMEs.30

Observations

Madagascar and El Salvador, like several other small nations such as Barbados and Tuvalu, were among the first to launch metaverse initiatives, specifically in diplomacy and tourism.31 These countries may have smaller economies and populations and limited access to resources, but this hasn’t stopped them being proactive in exploring the metaverse’s strategic potential for enhancing global visibility.32 For example, Barbados has a metaverse embassy and plans to develop more, positioning itself as a trailblazer in a new era of global diplomacy.33

Combining local initiatives with international collaboration is a practical way of driving development in the metaverse space without putting pressure on government resources or distracting from more pressing socio-economic and environmental considerations. However, to benefit truly, these countries may have to improve key aspects of their metaverse ecosystems, such as physical infrastructure and availability of tech talent.

Gearing up for success in the metaverse

As nations progress along their varied metaverse paths, certain actions will help them position themselves for success in this space:

-

Governments with the right capabilities can focus on creating cohesive, clear policies to support the growth of a metaverse ecosystem.

Guided by an overarching vision, these policies should be developed with industry experts and centred on the needs of citizens, ensuring all parts of society feel included in this future.

-

Collaborating with an international expert network or organisation can be an effective support mechanism for realising metaverse ambitions if resources are under strain.

This can facilitate collaboration on large-scale projects, enable knowledge sharing across industries, and bolster global brand-building efforts.

-

Striking a balance between global metaverse opportunities and the needs of citizens is important for ensuring the long-term success of a government’s metaverse vision.

The recent hype around the metaverse has made navigating its opportunities challenging. Governments should focus on practical use cases that offer a clear value proposition – one that is tangible and communicable to its people.

Conclusion

Our exploratory research shows governments are taking varied approaches to ensuring their citizens and institutions are prepared for the metaverse-enabled future. While we did not measure for causal relationships between “metaverse success”, “readiness” and “interest”, we can infer that high levels of both readiness and interest will give governments the tools and environment they need to make the metaverse transition – and thrive.34

To achieve this, governments are well advised to create policies that tackle the whole metaverse ecosystem: fostering a business-friendly environment, drawing in talent and investment, encouraging collaborations between public and private sectors, and promoting education in new technologies. Governments also play a crucial leadership role, providing strategic direction for the self-sustained growth of this ecosystem around principles that positively impact society.

About the author

Isabella Williamson is an emerging technologies strategist at Consulum. She advises governments on the implications of the metaverse, artificial intelligence and blockchain technologies for their organisations from a strategy, policy and communications perspective. Isabella is also an international public speaker on emerging technologies, contributing to platforms like GITEX’s Future Blockchain Summit and the UAE Tech Podcast, and authored one of the first pieces on the intersection between governments and the metaverse “Enter the Metaverse: Time for governments to be bold – and choose wisely”.

References

[1] In the context of this article, the metaverse refers to 3D-enabled digital spaces where users can interact with each other, powered by emerging technologies such as AI, blockchain, and virtual and augmented reality.

[2] Minecraft Player Count and Stats, Video Game Stats, November 6, 2023.

[3] Reuters, “Sweden first to open embassy in Second Life”, Reuters, May 30 2007; Government of Maldives, “Diplomacy Goes Virtual: Inauguration of Diplomacy Island and Virtual Embassy in Second Life”, Diplo, May 22 2007.

[4] Tinmaz, H, “Technology Giant South Korea’s Metaverse Experiences”, Springer Nature October 13 2023; Lubale, N, “South Korea To Launch Metaverse Fund – Find Out More”, Inside Bitcoins, March 13, 2023; “Indonesia launches metaverse collaboration initiative to boost metaverse industry,” Technode Global, March 15, 2023; Ye, J, “China’s industry ministry to work on standards for the metaverse”, Reuters, Sep 18 2023. Fries, T, “France Launches Consultation to Make a Metaverse Framework ‘A La Francais’”, The Tokenist, April 1 2023.

[5] Countries selected for our sample were those with active metaverse policies from the past two years. An additional two nations (Barbados and Tuvalu) with metaverse initiatives in place were identified, but readiness and interest scores could not be computed due to lack of data for several of the constituent metrics. Readiness scores were formulated through evaluations of local digital expertise, physical infrastructure and the business environment, while interest levels were derived from search-engine statistics.

[6] Interesse, G, “China Releases Three-Year Action Plan for Metaverse Industry Development”, China Briefing, Sep 25 2023.

[7] Pessarlay, W, “China’s Shandong province aims for $20B metaverse valuation by 2025”, CoinGeek, Sep 12 2023.

[8] “Dubai Metaverse Strategy”, The United Arab Emirates’ Government portal, Nov 7 2023; Sharma, A, “Sheikh Hamdan approves new phase of Dubai Metaverse Strategy”, The National News, November 24 2022.

[9] Webster, N, “Dubai to create virtual city in metaverse,” The National News, March 30 2022; “Dubai: Dewa becomes first local government organisation to launch platform on Metaverse”, Khaleej Times, October 9 2022; “UAE Government Officials Share Metaverse Ambitions”, FinTech News Middle East, October 23 2022.

[10] Pereira, D, “Speculative Design: “Virtual Singapore” is a Massive, Fully Functional Digital Twin of the Asian City-State”, OODA Loop, May 23 2023.

[11] For countries such as Spain and Latvia, talent and digital skills restrict overall readiness where there is indeed high interest. These countries may be compelled to hire talent elsewhere.

[12] Allen, N, “South Korea Will Put $187 Million Towards A Nationwide Metaverse Initiative”, The Coin Republic, March 1 2022.

[13] Dargan, J, “South Korea’s Science Ministry To Announce Pan-Government Strategy On Metaverse”, The Metaverse Insider, December 6 2022.

[14] “Korea’s Digital New Deal 2.0 Action Plan 2022”, Ministry of Science and ICT, January 26 2022; “The MSIT supports the creation of a metaverse ecosystem!”, Ministry of Science and ICT, February 28 2022.

[15] “South Korea Reveals Plan to Support an Expanded Virtual World Ecosystem”, Crypto Caster, February 28 2022.

[16] CHIPS for America, chips.gov, accessed 10 November 2023

[17] “Government Enters the Metaverse: Accenture Federal Technology Vision 2022”, Accenture Federal Services, September 12 2022.

[18] Department for Digital, Culture, Media and Sport, “Policy paper UK Digital Strategy”, Gov.UK, October 4 2022.

[19] HM Treasury, “Policy paper Spring Budget”, Gov.UK, March 21 2023.

[20] Shumba C, “UK Just Passed an Online Safety Bill That Will Apply to the Metaverse”, CoinDesk, September 20 2023.

[21] “Augmented reality and virtual reality”, Department for Business and Trade, Great Britain & Northern Ireland, great.gov.uk.

[22] “UK military enhancing training through virtual reality”, Defence Equipment and Support, gov.UK, June 10 2022.

[23] Al-Monitor Staff, “Saudi Arabia to invest billions in metaverse, blockchain technology”, Al-Monitor, February 1 2022.

[24] Cabral, A, “Meta launches the Mena region’s first metaverse academy in Saudi Arabia,” The National, February 7 2023.

[25] “Hegra in the Metaverse”, Royal Commission for AlUla; Flannagan, B, “Saudi Arabia’s new metaverse will help design $500bn city IRL”, Wired, February 1, 2022.

[26] Thompson, C, “Norway Steps Into Metaverse With Decentraland Tax Office”, Binance, October 26 2022.

[27] Savvy, Inc, “Madagascar to Join the Metaverse with Embassy, Exhibition Center”, Newswires, March 29 2022.

[28] Mattia, J, “El Salvador Pursuing A ‘Metaverse’ Online Casino,” CardPlayer, January 22 2022.

[29] “Indonesia launches metaverse collaboration,” March 15, 2023.

[30] Jiao, C and Dahrul, F, “Indonesia Launches Own Metaverse to Promote Its Small Businesses,” Bloomberg, August 1 2022.

[31] While Barbados and Tuvalu have metaverse initiatives in place, readiness and interest scores could not be computed due to lack of data for several metrics

[32] Lucy Craymer, “Tuvalu turns to the metaverse as rising seas threaten existence”, Reuters, November 16 2022; “Accenture wins Cannes top prize for Tuvalu digital & creative campaign”, Consultancy.com.au, July 4 2023.

[33] In November 2021, Barbados’ Ministry of Foreign Affairs and Foreign Trade partnered with Decentraland to establish a digital embassy, signalling the country’s ambition to explore more, similar projects as unique diplomatic opportunities. Wyss, J, “Barbados Is Opening a Diplomatic Embassy in the Metaverse”, Bloomberg, Dec 14 2021; Carter, R, “Which Countries Have the Top Metaverse Strategies?”, XR Today, March 24 2023.

Appendix References

[34] Since many metaverse policy initiatives have only recently been announced, it’s difficult to accurately assess their impact.

[35] “Digital Skills Gap Index 2021: Your tool to determine global digital skills levels”, Wiley, 2021.

[36] “Other policy relevant indicators: Distribution of tertiary graduates by field of study”, UNESCO dataset, 2017-2023.

[37] Kepios research and analytics.

[38] Data Reportal analysis based on third-party data points from GWI and data.ai.

[39] “Median Country Speeds”, Speedtest Global Index Ookla, August 2023.

[40] “Doing business 2020: Comparing Business Regulation in 190 Economies”, World Bank Group, 2020.

[41] Dutta, S, Lanvin, B, Rivera León, L and Wunsch-Vincent, S (eds), “Global Innovation Index 2022: What is the future of innovation-driven growth?”, 15th edition, World Intellectual Property Association (WIPO), 2022.

Appendix

Appendix A: methodology

Using desk research, we systematically identified 20 countries that had active policy initiatives related to the metaverse (including virtual worlds, interactive 3D virtual spaces, and related technologies) at national, regional, and local/municipal level between 2021 and 2023. The selected countries – spread across nine regions: North America, Latin America and the Caribbean, Western Europe, Eastern Europe, Sub-Saharan Africa, the Middle East and North Africa, South and Central Asia, and the Pacific – were each assessed for metaverse readiness and interest. Ultimately, we proceeded with analysis for 18 countries: while Barbados and Tuvalu have metaverse initiatives in place, readiness and interest scores could not be computed due to lack of data for several metrics.

Readiness

Metaverse readiness was assessed using a score derived from the mean of three equally weighted metrics: education and skills, physical infrastructure, and regulatory and business environment. These were calculated using the following sub-metrices:

Education and skills:

- The Wiley Digital Skills Gap Index (DSGI), which ranks 134 economies based on indicators that reflect the presence and advancement of digital skills.35

- UNESCO data on percentage of tertiary graduates in STEM fields, most recent year available.36

Physical infrastructure:

- Internet penetration: percentage of population with internet access.37

- Social-media penetration: percentage of population with one or more social-media profiles.38

- Median fixed internet speed in megabytes per second.39

Regulatory and business environment:

- The World Bank Ease of Doing Business Index (2020), which measures how conducive a country’s regulatory environment is to starting and running a business.40

- The World Intellectual Property Organization Global Innovation Index (2022), which evaluates the innovation-ecosystem performance of 132 economies around the world. 41

We normalised each sub-metric based on countries’ highest and lowest scores to make them comparable. Then, we computed the mean of the normalised sub-metrics for each country to determine the score for each metric.

Interest

Interest in the metaverse was assessed using search-engine trend statistics – specifically, the average number of searches for the term “metaverse” relative to total searches. We used various search engines and their corresponding trends-analytics services according to their popularity in the country in question. These included Google Analytics, Naver Analytics and Baidu Analytics.

Appendix B: Supplementary material / raw data

Results

Notes

- Countries included in the analysis are those with identified metaverse-related initiatives/policies in place at a national or regional level.

- The sub-metrices making up the readiness metric are scaled relative to the highest scoring and lowest scoring countries in that metric. The overall readiness metric is the mean of these normalised sub-metrices.

- The list of sub-metrices were evaluated based on availability of data, quality of data, and completeness of the database.

- Metrics are normalised, with 100 being the country with the highest score and 0 the country with the lowest score. All other countries are scaled proportionately between these two points.

- One cannot directly compare readiness vs interest. For example, one can’t say that Hong Kong is more interested than ready for the metaverse. But one can say that it’s almost twice as ready than Indonesia.

Singapore

Readiness score (rank) 97,28 (1)

Education and skills 100,00

Physical infrastructure 94,23

Regulatory and business environment 97,60

Interest score (rank) 71,51 (2)

UAE

Readiness score (rank) 90,48 (2)

Education and skills 97,01

Physical infrastructure 95,26

Regulatory and business environment 79,17

Interest score (rank) 62,74 (3)

South Korea

Readiness score (rank) 82,64 (3)

Education and skills 76,45

Physical infrastructure 76,26

Regulatory and business environment 95,22

Interest score (rank) 18,16 (16)

Mainland China

Readiness score (rank) 76.53 (4)

Education and skills 79.63

Physical infrastructure 65.07

Regulatory and business environment 84.89

Interest score (rank) 100 (1)

UK

Readiness score (rank) 74,56 (5)

Education and skills 58,60

Physical infrastructure 69,54

Regulatory and business environment 95,53

Interest score (rank) 34,99 (11)

USA

Readiness score (rank) 74,04 (6)

Education and skills 41,78

Physical infrastructure 83,19

Regulatory and business environment 97,14

Interest score (rank) 31,10 (12)

Japan

Readiness score (rank) 73,03 (7)

Education and skills 64,81

Physical infrastructure 70,22

Regulatory and business environment 84,06

Interest score (rank) 46,33 (7)

Estonia

Readiness score (rank) 72,52 (8)

Education and skills 69,29

Physical infrastructure 63,24

Regulatory and business environment 85,03

Interest score (rank) 58,65 (4)

Norway

Readiness score (rank) 72,49 (9)

Education and skills 54,57

Physical infrastructure 77,18

Regulatory and business environment 85,71

Interest score (rank) 29,44 (13)

Israel

Readiness score (rank) 72,28 (10)

Education and skills 68,73

Physical infrastructure 67,17

Regulatory and business environment 80,93

Interest score (rank) 36,08 (9)

France

Readiness score (rank) 69,27 (11)

Education and skills 59,52

Physical infrastructure 65,32

Regulatory and business environment 82,98

Interest score (rank) 35,90 (10)

Spain

Readiness score (rank) 67,54 (12)

Education and skills 41,42

Physical infrastructure 84,95

Regulatory and business environment 76,24

Interest score (rank) 46,17 (8)

Thailand

Readiness score (rank) 67,52 (13)

Education and skills 47,15

Physical infrastructure 83,04

Regulatory and business environment 72,37

Interest score (rank) 47,78 (6)

Saudi Arabia (KSA)

Readiness score (rank) 59,55 (14)

Education and skills 50,35

Physical infrastructure 70,81

Regulatory and business environment 57,48

Interest score (rank) 20,51 (15)

Latvia

Readiness score (rank) 57,26 (15)

Education and skills 32,87

Physical infrastructure 65,32

Regulatory and business environment 73,59

Interest score (rank) 56,43 (5)

Indonesia

Readiness score (rank) 39,20 (16)

Education and skills 31,25

Physical infrastructure 42,99

Regulatory and business environment 43,35

Interest score (rank) 14,42 (17)

El Salvador

Readiness score (rank) 27,54 (17)

Education and skills 13,62

Physical infrastructure 43,24

Regulatory and business environment 25,74

Interest score (rank) 25,32 (14)

Madagascar

Readiness score (rank) 10,73 (18)

Education and skills 30,97

Physical infrastructure 1,23

Regulatory and business environment 0,00

Interest score (rank) 0,10 (18)

Raw Data

If you would like to see the raw data, please contact this article’s author, Isabella Williamson, via the page’s contact form.